Nifty Rider | Ride high on Upside gains and Dodge downside wipeouts

Go long and short on NIFTY Futures while holding on to your long-term investments.

Go long and short on NIFTY Futures while holding on to your long-term investments.

What is NIFTY Rider all about?

Nifty Rider is a hybrid approach to trading and investing, designed for people with greater than 9 lakhs of existing investments in the market.

This model has two parts: a trading part and an investing part.

The trading part uses NIFTY futures, and the Investing part can comprise anything you hold for the long term, stocks, ETFs, and mutual funds.

The trading part goes both long and short on the market, and the investing part stays invested (long) always.

Confusing? Here’s an example.

Investing component

Let's say you started with this model on the 3rd of Jan 2022 till the 7th of April 2022

You already have 8 lakhs in a NIFTY Mutual fund for the investing component. That's a prerequisite.

The number of units of NIFTY MF that you hold = 8,00,000/190 (Per Unit Buy Price) = 4211 Units

| Date | NAV | Units | Position Value |

|---|---|---|---|

| 3rd Jan 2022 | 190 | 4211 | 800000 |

| 7th Apr 2022 | 191 | 4211 | 804211 |

In three months, you have a profit of 4211/800000 = 0.52%

This is the investing component. Let's move to the more interesting part, the Trading component of the model.

Trading component

You need to keep Rs. 1L to buy and sell 1 lot of NIFTY Futures.

Before we move further - a small intro to NIFTY Futures - Siip it if you how Futures work

In futures trading, there are four key concepts.

- Lot size - This is the minimum quantity of contracts you can buy or sell. It's decided by the exchange. Currently, the lot size for NIFTY Futures is 50.

- Margin - This is the money you need with your broker to take a long or short position in the futures contract. Think of this as similar to a down payment you make when buying a house. The current margin required for one lot of nifty futures would be close to 1.1 L. You can use this calculator to check - https://zerodha.com/margin-calculator/SPAN/

- Contract Value - This is the value of the position that you are taking. It's calculated by multiplying lot size with the current price of the underlying index, say for example, if NIFTY is at 18000, the current value of nifty futures will be 18000*50 = 9L. By blocking 1.1L, you are taking a position worth 9L. Think of Contract value as the house's market value you want to buy.

- MTM (Mark to market) - In Futures trading, when you have gains, that cash gets deposited into your brokerage account at the end of the day. Likewise, when there are losses, your cash from your brokerage account is deducted from your brokerage account. That’s why you must keep some buffer cash in your brokerage account.

Wohoo! Now you are all set to understand the magic of the Trading component in the NIFTY Rider model.

Back to Trading component

Here you need to go long or short (buy or sell) 1 lot of nifty futures based on the signals from the model. This is a positional model, meaning typically, we hold the trades for as long as the signal indicates.

Here are the futures trades you would have taken if you had started from 3rd of Jan till the 7th of April. 2022

| Entry Date | Entry Price | Exit Date | Exit Price | Direction | Period (Days) | Trade P&L | Cumulative P&L |

|---|---|---|---|---|---|---|---|

| 03-Jan | 17503 | 18-Jan | 18153 | Long | 15 | 651 | 651 |

| 18-Jan | 18094 | 31-Jan | 17341 | Short | 12 | 753 | 1404 |

| 31-Jan | 17282 | 31-Jan | 17344 | Short | 0 | -62 | 1342 |

| 31-Jan | 17394 | 31-Jan | 17352 | Long | 0 | -42 | 1300 |

| 01-Feb | 17585 | 01-Feb | 17376 | Long | 0 | -209 | 1091 |

| 01-Feb | 17294 | 01-Feb | 17544 | Short | 0 | -250 | 841 |

| 02-Feb | 17744 | 04-Feb | 17543 | Long | 1 | -200 | 641 |

| 04-Feb | 17484 | 04-Feb | 17549 | Short | 0 | -65 | 576 |

| 07-Feb | 17396 | 09-Feb | 17372 | Short | 1 | 24 | 600 |

| 09-Feb | 17443 | 11-Feb | 17427 | Long | 1 | -16 | 584 |

| 11-Feb | 17318 | 15-Feb | 17283 | Short | 4 | 35 | 619 |

| 15-Feb | 17354 | 17-Feb | 17282 | Long | 1 | -72 | 547 |

| 18-Feb | 17317 | 18-Feb | 17291 | Long | 0 | -26 | 521 |

| 21-Feb | 17311 | 21-Feb | 17302 | Long | 0 | -9 | 512 |

| 23-Feb | 17134 | 23-Feb | 17195 | Short | 0 | -61 | 450 |

| 23-Feb | 17124 | 03-Mar | 16746 | Short | 7 | 378 | 828 |

| 03-Mar | 16612 | 09-Mar | 16206 | Short | 6 | 407 | 1235 |

| 09-Mar | 16321 | 24-Mar | 17118 | Long | 14 | 797 | 2031 |

| 24-Mar | 17264 | 25-Mar | 17130 | Long | 1 | -133 | 1898 |

| 28-Mar | 17042 | 28-Mar | 17141 | Short | 0 | -100 | 1798 |

| 28-Mar | 17216 | 07-Apr | 17733 | Long | 9 | 516 | 2314 |

By trading one lot of NIFTY Futures for nearly three months, you would have made a profit of 2300 points.

2300 points = 50 * 2300 = Rs. 1,15,000

Calculating your three months return in Nifty Rider

Investing component + Trading component

- You made Rs. 4200 on an investment of 8L in the NIFTY Index

- You made Rs. 1,15,000 on investment of 1.1L through NIFTY futures

Note these returns do not include costs and taxes.

Why does this hybrid investing model work? What’s the logic behind it?

There are three primary reasons this approach to investing works.

- NIFTY50 is a trending index - The model works because the NIFTY50 index is a trending index on certain time frames. That means if the index starts going up, it continues to go up for a few days or weeks. Likewise, when it starts going down, it continues in that direction. The model tries to capture such moves.

- Leverage is capped - Futures trading is known to be risky as there is leverage. Leverage, in simple words means taking a position that's worth much more than what you are paying for. Both profits and losses get magnified. In the current hybrid model, we cap this leverage by including the ‘Investing’ component.

- Comes with a Stop Loss on the trading component - In this hybrid model, the trading component offers both risk and return; hence, having a stop loss helps curb both losses and capture accumulated gains.

Trend-following is a highly validated concept in the world of investing. This model applies the concept specifically to the NIFTY50 index with an element of limited leverage.

Is this model for me?

You should invest in this model if

- You have existing investments in the stock market to the tune of 8L or more; you would like to protect your investments from market crashes while adding to your gains in an up trending market.

- You want to make fresh investments in the market for upwards of 8L and get the benefits of protection from crashes.

- You are an options trader and want to use the model signals as a bias for taking your options trades.

- You want to have a long or short bias of the index generally.

When markets crash, to what extent does this model protect my investments?

Data tells us that the model captures, on average, 45% of it whenever a market crash extends beyond a couple of days.

For example, let's say the markets are at 18000 now, and it starts crashing, the short on the system may come in at 17900, and the market may make a low of 17200 before bouncing back. That was an 800-point crash. Of which the system may - on average, capture 360 points.

However, due to some personal reasons, if you want to exit at any point during the crash, the model should cover your losses greater than 45%.

For example, if you had to exit all your market investments at 17300, you could book the futures short with 600 points gains and your investing component as well.

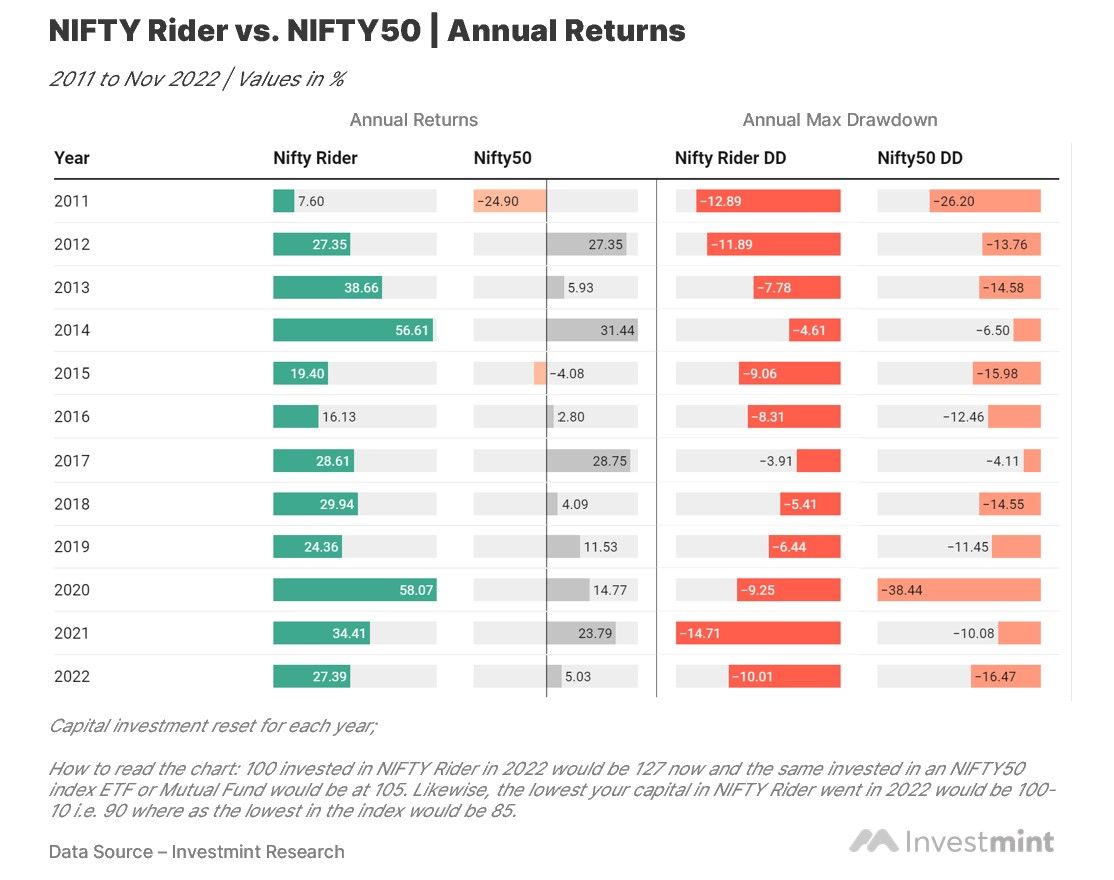

Returns of the model over the years

How to trade the NIFTY Rider model?

Follow these 4 steps, and you are all set!

- Make sure you have existing market investments worth approximately 9L (min). This can be stocks, ETFs, or even Mutual funds.

- Have the F&O segment enabled with your broker account.

- Check the signal status on the app, if Long, you need to buy 1 lot of NIFTY Futures’ current month's expiry. NRML/Positional. (1 Lot each for 9L of investments)

- Place a Stop Loss order based on the price provided. Use SL-L order. Update it every day at 9:15.

Placing the stop loss order

- Check the stop loss level provided on the model page of the investmint app

- Place an SL-L order with your broker.

Example - For a long trade, if the Stop loss price is 18550, you would need to use 18550 as the Trigger Price and 18555 as the Limit price for the SL-L order. Likewise, for a short trade, if the Stop loss price is 18550 you would need to 18550 as Trigger price and 18545 as limit price. This will ensure that the order goes through with a maximum 5 point slippage.

Must read - before you start!

Your market investments in Stocks, ETFs, or Mutual Funds are key. The model works as stated only in combination with the ‘investing part’. Do not trade only the ‘Trading part’ in isolation.

Maintain adequate buffer cash in the broker account for MTM losses.

The returns stated on the app include the returns on both the investing and the trading legs.

You need to place a stop loss daily once you are in the trade.

For any questions or clarifications, please reach out to us at support@investmint.club or, or better still, drop into our vibrant telegram channel with close to 4000 active minters.

Follow us on Twitter and stay up to date on all things markets